Home Automation is Changing the Residential Security Market

September 2, 2014 - PSPA Editoral Staff

Homebuilders as well as homeowners are no longer purchasing alarm systems solely for security, but want to add more features that are life safety and convenience driven.

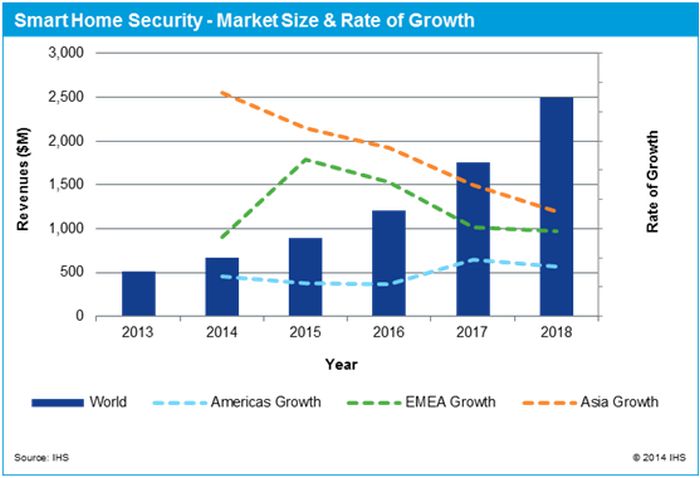

As more consumers are purchasing home automation solutions, the smart homes market is forecast to reach $2.4 billion by 2018, according to a recent report from research firm IHS.

The report notes most homeowners initially purchased residential intrusion alarm systems to protect property. However, when multiple systems operators began offering home automation in conjunction with security in 2012, many homeowners no longer purchased security equipment solely for security reasons. Rather, many users want to add more features that are life safety and convenience driven.

IHS estimates the world market for security devices in traditionally monitored homes, such as ADT, to be worth about $2.9 billion in 2014, compared with $670 million for smart homes, such as ADT Pulse. Thus, by 2018, the research firm predicts that the revenue of smart homes will top $2.4 billion.

RELATED: Lowe’s Study Reveals Security Is Main Reason Consumers Purchase ‘Smart Home’

Although the rapid changes to the residential security market have been mostly positive, the influx of competitors has dramatically changed the make-up of this industry, according to the report.

In the past 10 years, professionally installed, centrally monitored systems were the main offer available to end-users. However, this has changed as more monitoring companies, MSOs, electric companies, retailers and DIY (do-it-yourself) equipment manufacturers are offering products to consumers.

Additionally, end-users can find innovative products from new market entrants such as Google and Apple which until recently did not have an offering for the residential security or home automation space.

Manufacturers will see benefits in the smart home space, despite the increase in competition, because the market offers opportunity for all due to the current, low penetration rate of smart products.

This will lead to more products and pricing options becoming available to end users, according to the report.

And what does the everchanging availability of ‘smart’ residential security technology mean for dealers moving forward?

For the dealers, installers and monitoring companies, the release of new and/or retrofitted solutions creates better sales opportunities as the need to best meet customer demands is fundamental in todays word of high-tech hardware and software.